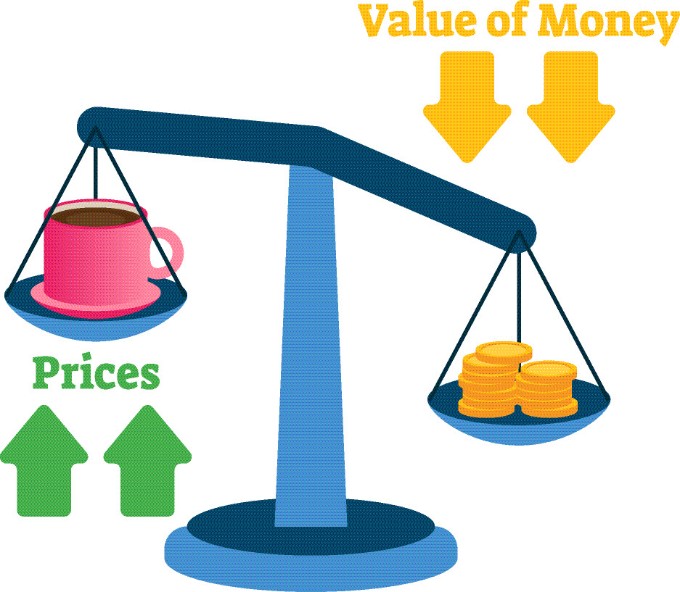

There is a new buzzword in town, “Inflation” and many of us are trying to make sense of what it is and how it affects us. In January, the price of goods rose by 7% in the United States and although we reside in the Caribbean, we will definitely feel its effects. But what is inflation? Here’s a 1-minute video explaining everything you need to know.

So, are you worried about what inflation can do to your spending power or the value of your assets? I am certainly worried about mine. Accounting for inflation is an important part of any consumer or investor’s financial plan. Here are two steps you can take to better protect your finances from inflationary pressures.

- Consumers; yes, that is you and me: Save for emergencies but don’t keep too much cash in the bank.

It’s always important to have an emergency fund that can at least cover your fixed monthly expenses for a period of time and that is why you need to know your hourly to salary conversion; however, in higher inflationary environments the value of this fund may yield less. To reduce the loss of your purchasing power, start searching for a better return. Seek yields that return higher than the inflation rate. For example, invest in the stock market.

In inflationary times, you don’t want to have too much cash on the side but you also don’t want to have too little in the event that you need a safety net.

If you don’t have an emergency fund or want to start investing, send us a message

https://myfinancefocus.com/contact/: How To Protect Your Wealth in Inflationary Times- Investors: Diversify your portfolio with some inflation-safe investments

The key to surviving an inflationary environment is to save and invest and consistently build a well-rounded portfolio. Consider stocks that have high growth potential, dividend-paying equities, and consumer staples when adjusting your portfolio. Remember, keep your risk tolerance in mind and don’t make erratic decisions.

If you are investing for the long term, annualized dividend increases over time have outpaced inflation. During inflationary times, the value of your investment can also increase if you are invested in real estate. Property values tend to rise and fall in line with inflation. Also, although they tend to be volatile, commodities and precious metals tend to be a safe haven from inflation.

What’s the point?

Money is a tool and inflation can affect its usefulness. At some point in time, Caribbean countries will experience imported inflation. As most of us are consumers, we can protect ourselves from the effects.

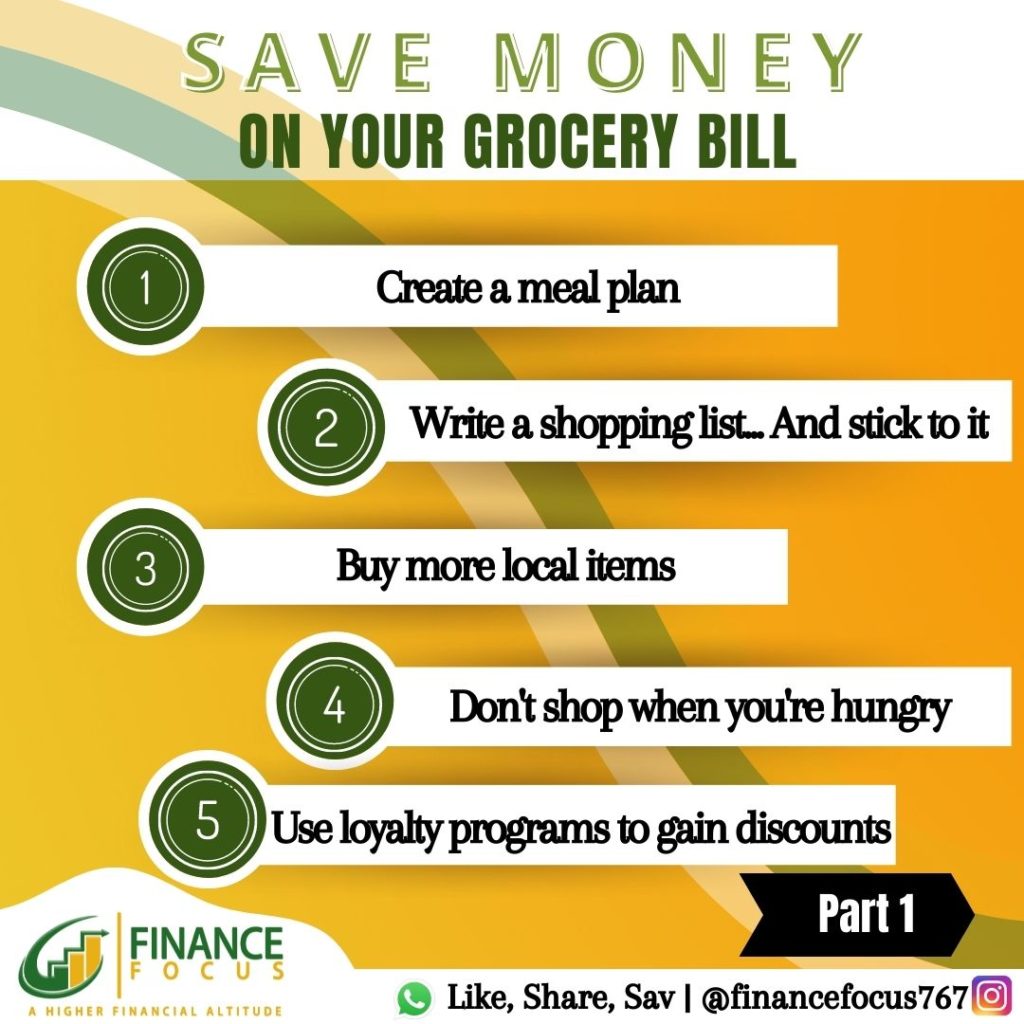

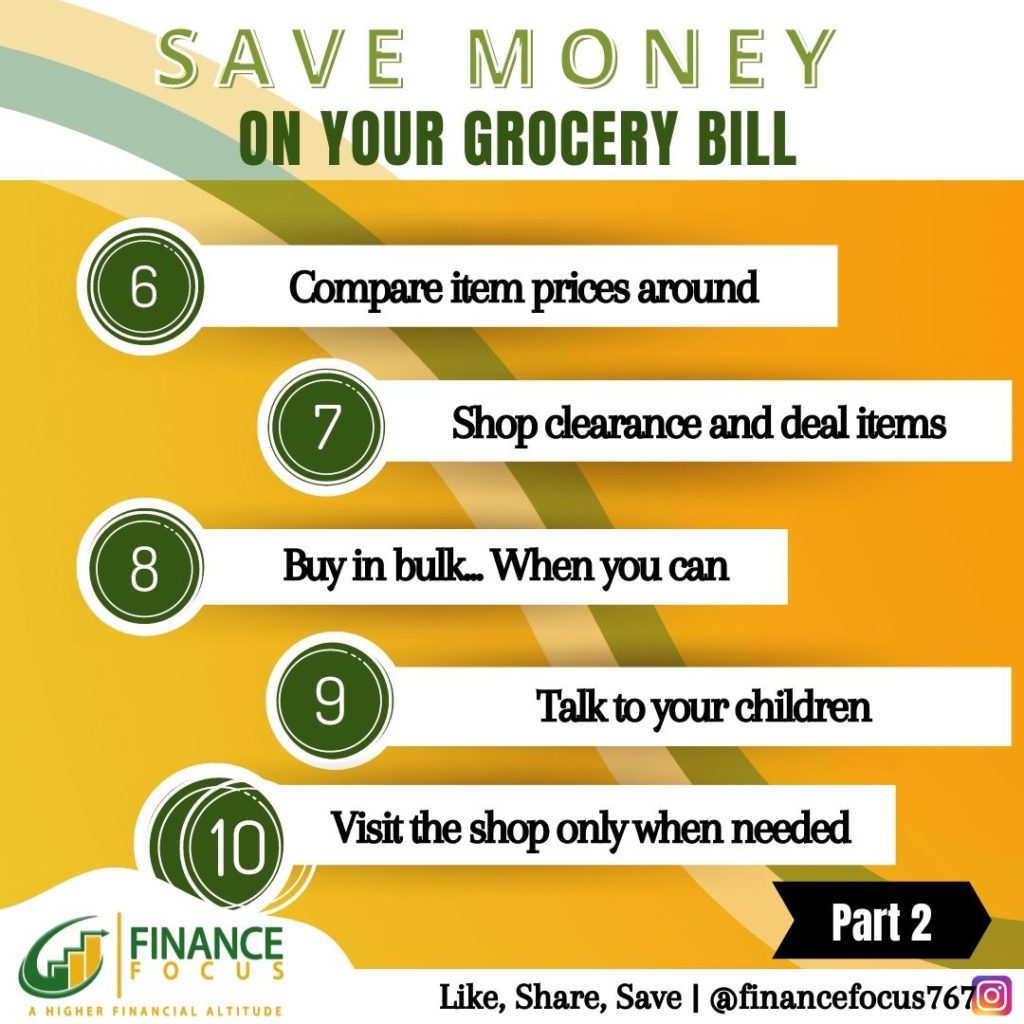

Quick tip: To reduce your grocery bill, create a backyard farm (if space is available). Here are a few more money-saving tips.

Did you like this article?