As a financial coach, I make money mistakes too…

If you know my story, you’ll know that I suffered from poor money management. Over the past four (4) years as a financial coach, I’ve definitely gained a better understanding of my finances and how to set (and achieve) my money goals. But, I’m only human and I am still capable of making some money mistakes

https://myfinancefocus.com/luanas-story/: As A Financial Coach, I Make Mistakes TooI’ve overcome a lot of my fears and anxieties with money by acknowledging that making mistakes can serve as a lesson to learn and improve. However, here are my three biggest money mistakes, so you don’t have to make them too.

- I was too strict with myself

You’ve heard me say it numerous times; personal finance is – personal. And for me, it was a sensitive subject to discuss.

I checked the numbers in my bank accounts too often while worrying more about surviving the day, week, and month. And I worried less about what really mattered – experiences with enjoying my money.

While having financial goals, like saving and following a budget, are extremely important, so is enjoying your life. With that acknowledgment, I began to see money less as a goal to reach and more as a way to achieve what I want, bringing more happiness and fulfillment into my life.

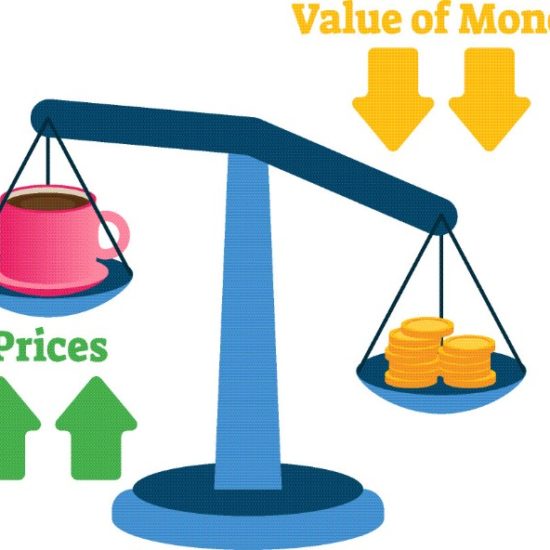

Tip: Money is a tool that gives you the freedom to buy new things, have new experiences and spend time with those who matter.

2. Not planning ahead enough for big expenses

There are expenses that occur unexpectedly, but there are other expenses that you know are coming up, that are large enough to derail your finances.

While I did regularly set aside money for emergency savings each month, I found myself dipping into that account for an expense that I had plenty of time to anticipate.

For example, I once signed up and paid for a personal development course. Even though the course was advertised months in advance, I found myself unprepared for how much money I would spend to attend. I ended up using some of my emergency funds to bridge the gap to enroll.

Now, some may agree that this was not an emergency. Your emergency fund is money specifically for emergencies. Using it for non-emergency reasons can make you less prepared if a real emergency rolls around. My next big expense is coming in a few months – and this time, I think I’ll be much more ready.

Tip: By spending a little time compiling all the costs associated with large purchases and how they fit into your budget can help you make a plan in anticipation.

3. Mixing personal and business expenses

When I started my business, it was a hobby. I had never started a business before, I just knew I was great at building a brand, generating buzz, and creating content. I wasn’t making much money when I first started but I did have a few expenses; mostly marketing and tools. I found myself using my personal money to cover business expenses and would also use the business income to satisfy my own needs.

As a result, it became difficult to understand the direction my hobby-turned-business was going. I was also becoming dependent on my side hustle to survive, rather than it was a compliment to my lifestyle.

In an effort to remedy this, I opened a business account and directed all receipts and payments through it. I also began paying myself a small wage to cover specific personal expenses.

Tip: The golden rule of business is to avoid mixing personal and business expenses. Instead of borrowing unlimited money from your personal accounts, set a limit to how much you’re willing to fund your business on a monthly basis.

Money coaches are not immune to money mistakes. I certainly am not. But over the years, I have seen progress with my relationship with money which has minimized these mistakes. After all, I should be taking my own advice.

Did you like this article?

You sound just like me, when I started my business as an email money mindset coach and money management tutor. I was operating it more as a hobby than as a business, as I worked full-time otherwise and the money mindset and money management was my part-time job. I have made more money mistakes than I could count and even wanted to throw in the towel on both businesses, as it became more a burden that left me burnt out than a blessing. I’ve learned and continue to learn and get better each and every day. Thanks for sharing your story.

Certainly Avion,

We just have to continue taking one day at a time, celebrate our wins and learn from our mistakes. Thanks for your comment.