Did you know that January 19 is called Quitters Day? A study of 800 million activities predicts that most new year’s resolutions are abandoned on that day. Will this be you?

One of the main resolutions that we all have at the beginning of a new year is to save more. For as long I remember I struggled with saving money. I lived from paycheck to paycheck and thought that surviving was a greater priority than saving money. Little did I know that by diligently saving, this money would help me survive the aftermath of a Category 5 Hurricane.

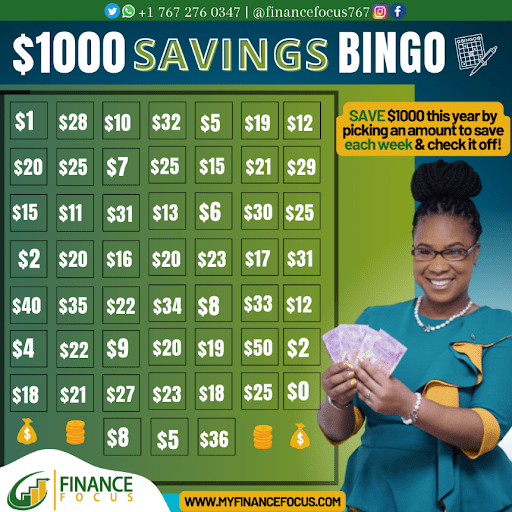

A question I often get is, “how did you save on a small salary?” There is no one size fits all saving method or plan. Personal finance is merely that, personal. The key to successfully saving money is YOU. But to help you get started, I will share a few tips on how you can save money on a small income. As a bonus, I have also added a saving plan to guide you throughout 2022.

Build a budget based on your lifestyle

How can we save, pay down debt, enjoy needs and buy wants? We can do it all with budgeting. When I speak about budgeting, I emphasize that one should budget based on one’s lifestyle. For example, I value self-care and as such I ensure that in my budget there is room to enjoy spa days, exploring new restaurants and entertainment options. One of the simplest ways to identify your lifestyle is by subscribing to the 50/30/20 budget rule. It’s a popular budgeting technique which allows you to be flexible with your money by highlighting your needs, wants and saving goals. Learn to budget, understand your finances and enjoy your life.

Take a look at your spending habits

Many times, we may live above our means or find it difficult to identify when we need more means to survive. This behavior inhibits our saving goals. I have seen so many suffer from saving anxiety without realizing that they have a choice to improve their habits or remain stuck. Tracking spending habits can get overwhelming at times but answer this question, “if I keep going in the same direction, where do I see myself in one year?” The answer to this question should fuel you to take immediate action and if you feel stuck, sign up for a free discovery call to get started.

Automate your savings

It’s easy to forget to save and sometimes, we ignore it entirely because of “competing priorities.” But let’s be honest with ourselves, if we don’t put the money aside, we won’t have any money when we need it. Money tells us to “save me and one day I will save you”. Similarly, to your monthly deductions, sign up with your employer to remove a comfortable amount from your salary into a savings account at your favorite financial institution. As such, it will be easier to pay yourself first. But how can you avoid tapping into that account? Do what I do. Open an account with no ATM card to limit the convenience of withdrawals.

If you are a beginner or have difficulty with saving money, I would recommend focusing more on the habit and consistency in saving rather than the amount. Use this saving plan and start small. Over time, once you develop that discipline you can increase the contributions towards your saving pot and your saving goals.